per capita tax reading pa

Per Capita Tax. The wilson school district tax office normal business hours of monday friday 730 am 400 pm.

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

What is per capita tax.

. Per Capita means by head so this tax is commonly called a head tax. Each resident or inhabitant over eighteen years of age in every school district of the second third and fourth class which shall levy such tax shall annually pay for the use of the school district in which he or she is a resident or inhabitant a per capita tax of not less than. Wilson school district 2601 grandview blvd west lawn pa 19609.

What is the Per Capita tax. Per capita tax is collected by the Exeter Township Tax Collector Charles I. Occupational Assessment Taxes are assessed on all employed residents that hold an.

Unpaid Per Capita taxes are turned over to the G. Per Capita Tax. Mifflin School District Per Capita Tax - 1470 for every person over 18 years of age who resides within the school district.

Per Capita Tax A per capita tax is a flat rate tax equally levied on all adult residents with a taxing district. Residents of Lower Alsace Township or Mount Penn Borough 18 years of age and older regardless of work status. For most areas adult is defined as 18 years of age and older.

Section 6-679 - Per capita taxes. It is not dependent upon employment. Posted July 6 2022.

Harris Agency for collection. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction.

It is not dependent upon employment. Local Services Tax A local services tax is paid by everyone working in the Township. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ.

Fiscal year starts March 1. Exoneration from tax is applicable to the current tax year only. Payments may be mailed to Wilson School District co Fulton Bank PO.

Per Capita Tax A per capita tax is a flat rate tax equally levied on all adult residents with a taxing district. Why do I have to pay a per capita tax. 1000 annually per individual.

Should you have any questions please call Carol Leiphart at. City of Reading. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ.

Exeter Township does not assess a municipal per capita tax. Reminder to pay your Per Capita tax bill before December 31st. Discount Amount Taxes must be paid by September 30 for 2 discount.

Payments can also be made online by clicking on the following link. In other words if you. Access Keystones e-Pay to get started.

Per Capita means by head so this tax is commonly called a head tax. You must file exemption application each year you receive a tax bill. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership.

Per capita exemption requests can be submitted online. The Tax Collector will have office hours from 930 to 1230 PM on Tuesdays starting in September through December. There is a 2 discount available for payments made in March andor April of the current tax year.

Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. As of January 1 2017 the Tax Collector no longer accepts cash. The Tax Collectors office is located at the Boroughs Municipal Building 999 E.

Annual 2022 Real Estate and Per Capita tax bills have been mailed. Currently there is no per capita tax payable to the Township. Each adult resident pays 10 annually to the School District.

Box 7625 Lancaster PA 17604 or can be made in person with the original bill at any Fulton bank branch. Each adult resident pays 10 annually to the School District. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction.

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. The City of Corry Per Capita tax is 1500. Municipalities and school districts were given the right to collect a 1000 per capita tax under ACT 511 and School Districts an additional 500 under ACT 679 School Tax Code.

The application form may be used by a PA taxpayer whose community has adopted one or more tax exemptions. All july 2022 per capita and real estate tax bills are due by december 31 2022. Why do I have to pay a per capita tax.

When is it levied. Per Capita means by head so this tax is commonly called a head tax. Check your current bill for more information.

Payments may be mailed to.

York Adams Tax Bureau Pennsylvania Municipal Taxes

Per Capita Tax Exemption Form Keystone Collections Group

Per Capita Tax Exemption Form Keystone Collections Group

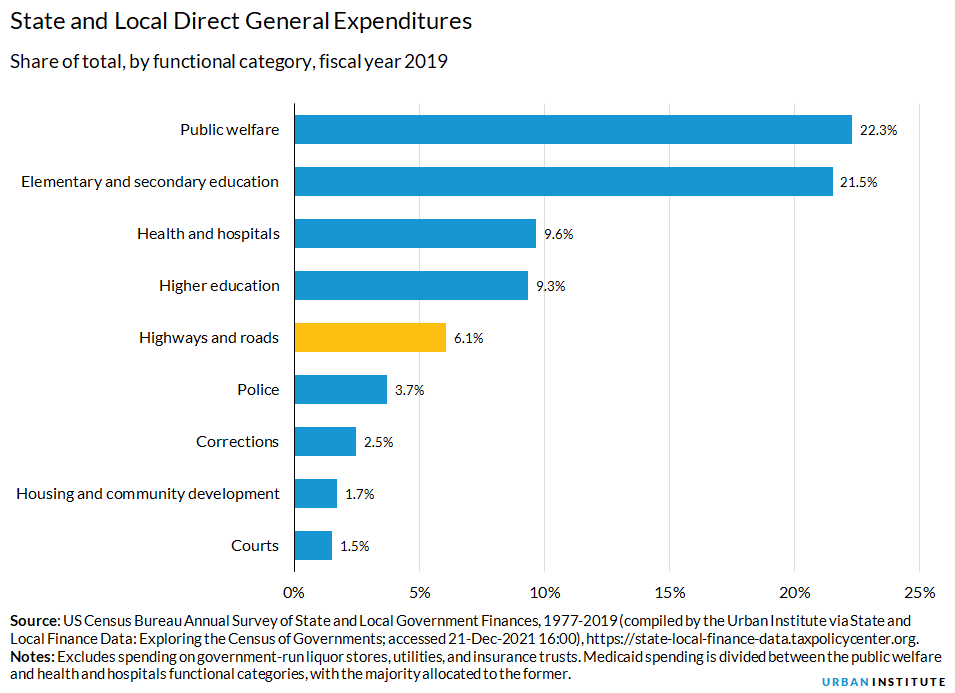

Highway And Road Expenditures Urban Institute

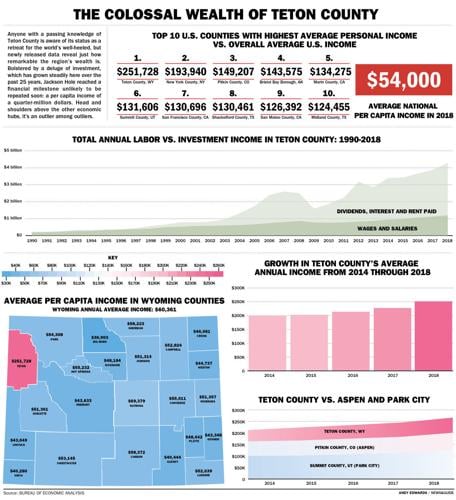

Teton Leads Nation In Per Capita Income Town County Jhnewsandguide Com

Population And Gdp Per Capita Ppp Data Derived From The World Download Table

Explore Per Capita Income In Alabama 2021 Annual Report Ahr

Real Estate And Per Capita Tax Wilson School District Berks County Pa

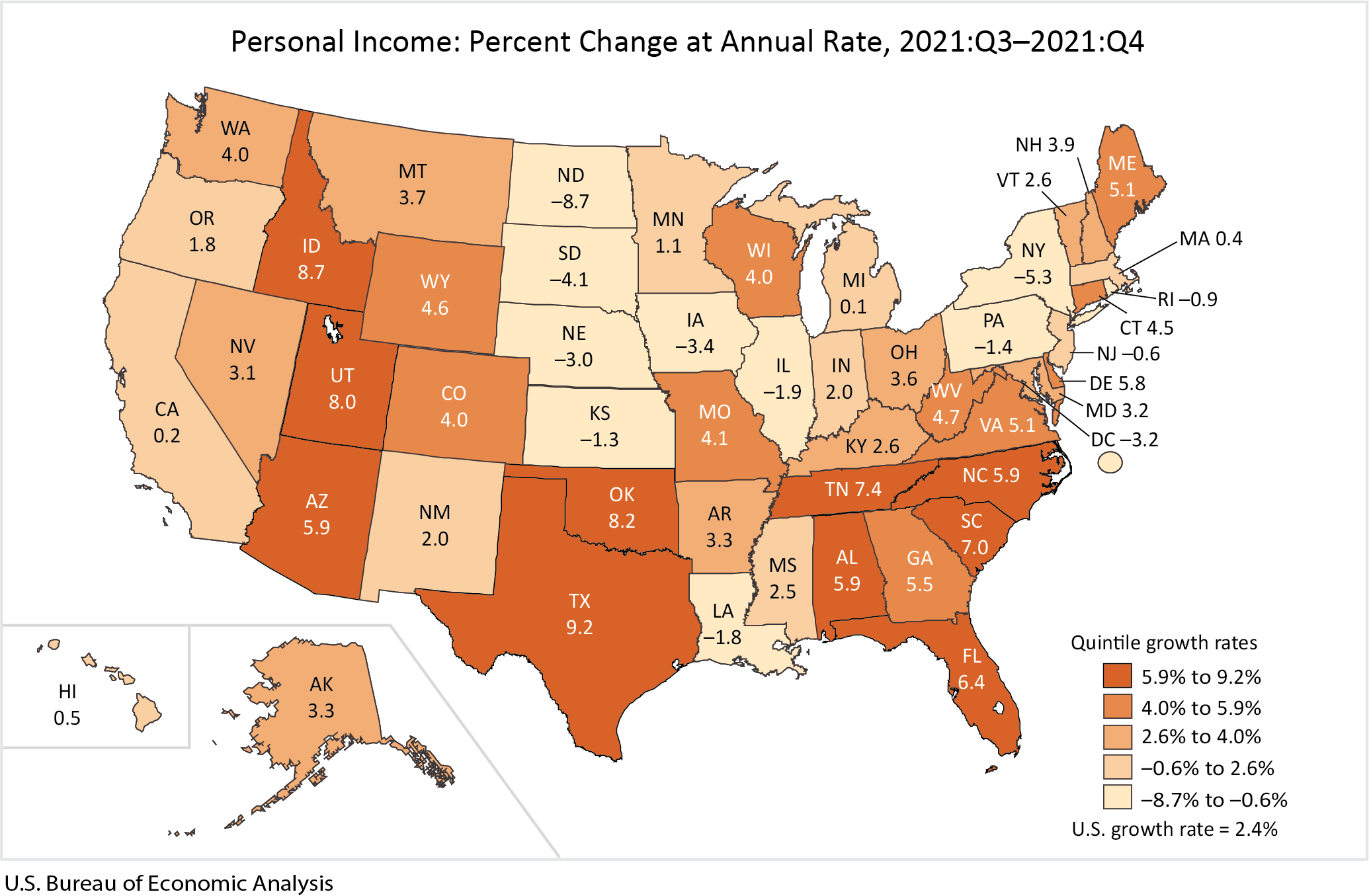

Personal Income By State 2021 Preliminary And 4th Quarter 2021 U S Bureau Of Economic Analysis Bea

U S Per Capita Income By State In 2021

List Of U S States And Territories By Gdp Wikiwand

State Local Property Tax Collections Per Capita Tax Foundation